How Joel Greenblatt Teaches You to Think: Class #1 at Columbia

From Mr. Market to Small Cap Goldmines — Timeless Lessons in Value Investing

🔍 Discovering One of the Best Hidden Resources in Investing

There are a few websites that truly change how you learn as an investor.

For me, csinvesting.org was one of them.

Back when I started my investment education, access to truly high-quality material wasn’t what it is today. There were books—yes—but very few sites offered deep, thoughtful insights. csinvesting stood out immediately. It was quiet, no-frills, and absolutely packed with timeless content: old case studies, lecture notes, PDF libraries of rare investment memos. You could tell it was built by someone who loved learning and wanted to share that love with others.

I still remember the feeling of stumbling across it for the first time. It felt like opening a forgotten archive. Late nights, pages bookmarked, Dropbox folders overflowing—those memories have stuck with me. More importantly, the lessons I absorbed there shaped the way I think about value investing to this day.

Before we dive into the csinvesting’s class notes from Joel Greenblatt’s legendary Special Situations course at Columbia Business School, I want to take a moment to acknowledge John Chew, the creator of csinvesting and the person who preserved this content for all of us.

👤 John Chew — The Mind Behind csinvesting.org

John Chew is not your typical finance professor or fund manager. He’s taken a far less conventional path—and that’s exactly what makes his voice so valuable.

Chew started out as a commodity trader in the 1980s, later became a floor trader in Chicago, and went on to work as a securities analyst and investment banker. Eventually, he pivoted into entrepreneurship, building and selling two companies (one in e-commerce, the other in energy). Along the way, he cultivated a passion for investing—and more importantly, for teaching others how to think like an investor.

Notably, Chew is entirely self-taught. He never pursued a traditional finance degree. From those experiences, he built csinvesting.org—a site designed to teach investing through case studies, not theory.

His philosophy is grounded in:

Deep value investing with a margin of safety

Contrarian thinking and independent research

Patience and emotional discipline

Studying history and learning from real-world examples

What makes Chew’s work so influential is that it’s not abstract. He’s been in the trenches—trading commodities, valuing businesses, running companies, and investing his own capital. His writing reflects that practical wisdom. There’s no fluff, just signal.

And there’s no sales pitch. csinvesting is entirely free, which makes it one of the most generous, authentic educational resources in the field. Over the years, it has developed a kind of cult status among serious value investors—a "Value Vault" for students who want to dig deeper.

🎓 Class #1 — Joel Greenblatt’s Investing Mindset

Now let’s turn to Class #1 of Joel Greenblatt’s course at Columbia. For context: this is a real MBA class, taught by a legendary investor who managed Gotham Capital, produced over 40% annualized returns, and authored two of the most useful investing books of the last few decades.

From the very beginning, Greenblatt frames investing in simple but powerful terms:

“Prices fluctuate more than values—so therein lies opportunity.”

That idea—central to value investing—is surprisingly easy to forget. Greenblatt explains why this happens:

“People invest with their emotions.”

Markets don’t just move on facts; they move on sentiment, groupthink, fear, FOMO. If you can stay rational while others react, opportunity arises.

The implication? The edge doesn’t come from activity or intelligence alone—it comes from discipline, from being able to consistently identify mispricings and have the emotional fortitude to act.

🧠 How to Win: Process Over Prediction

Greenblatt lays out a clear roadmap:

“If you do good valuation work and you are right, Mr. Market will pay you back. In the short term, one to two years, the market is inefficient. But in the long-term, the market has to get it right—it will pay you back in two to three years.”

It’s a powerful concept: markets aren’t efficient enough to stop you from beating them, if you’re patient and prepared. The catch? You have to live through short-term doubt.

Where should you focus?

“Focus on small caps where the markets are more inefficient. There is less analyst coverage so less information flow. You have the chance to find prices more above or below value.”

🧑🏫 Learning from Others: The Value Investors Club

Greenblatt also founded one of the most useful platforms in modern investing: the Value Investors Club (VIC). It’s a private forum where approved members post detailed investment write-ups—and it’s one of the rare places online where idea quality is consistently high.

Greenblatt explains how to use it:

“Read the reviews above 5.7 with many reviewers. Usually 5.5 and above is pretty good… You see smart investors asking questions. There is a lot to choose from here. It is a great learning tool.”

And it is. One of the hardest things in investing is the delayed feedback loop—it can take years to know if your thesis was right. But by studying VIC writeups and looking back at outcomes, you accelerate that learning curve. You start to see how good investors structure ideas, what assumptions they make, and where things go wrong or right.

That’s how I learned too—by reading VIC posts from five years ago and seeing how things unfolded. It’s one of the most underrated ways to internalize pattern recognition.

📊 The Tools of Valuation

Greenblatt teaches four key ways to value a business:

**“We have four ways to value a company:

DCF or intrinsic value

Relative value

Break-up value

Acquisition value”**

Rather than relying on one framework, he encourages students to triangulate. Different situations call for different tools.

But valuation alone isn’t enough. You also need to assess the quality of the business.

“Do I care about the ROE? I care about the return on capital (ROIC).”

Greenblatt emphasizes ROIC over ROE, because it measures true business quality. That distinction becomes crucial when you're trying to filter “cheap but bad” from “cheap and good.”

🧪 Screening: From Graham to the Magic Formula

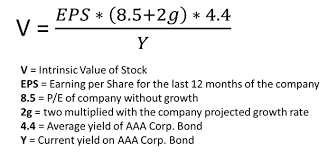

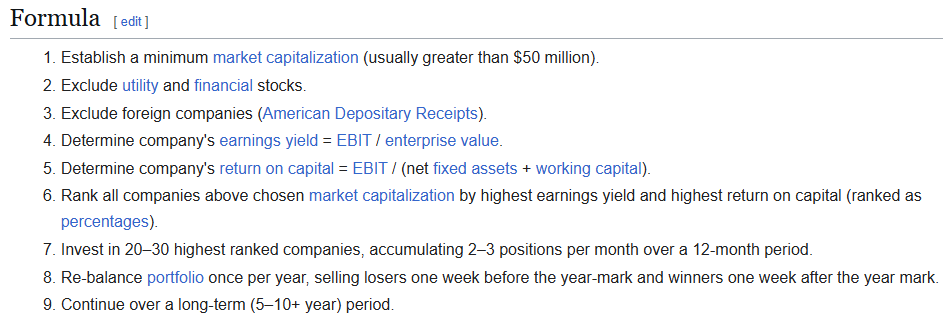

The class ends with two foundational frameworks:

Graham’s Formula: A simplified intrinsic value formula based on earnings and growth assumptions

The Magic Formula: Greenblatt’s own stock screener, which ranks stocks based on a combination of ROIC and earnings yield

While Greenblatt doesn’t suggest blindly buying screen results, these tools are valuable for narrowing down a universe of ideas—especially in small caps where inefficiencies abound.

🧭 How Value Gets Realized

Even great ideas need a way to unlock value. Greenblatt is clear about this:

“I guarantee that if you do a good job valuing a company, Mr. Market will eventually agree with you... Smart investors search for bargains, companies buy back their own shares, and the takeover or possibility of a takeover… work together to move share prices toward fair value.”

In other words, value realization often hinges on capital allocation and governance:

A company buying back shares signals confidence

M&A activity can act as a catalyst, enabled by sound governance

To avoid the trap of a cheap stock staying cheap, you need either internal action (buybacks, dividends) or external pressure (activism, acquisition interest).

🔄 Key Takeaways from Class #1

Prices ≠ Value: Emotions distort markets. Your job is to stay rational.

Time Horizon Is a Superpower: Be willing to wait 2–3 years.

Small Caps = Inefficiencies: That’s where mispricings live.

Learn from Others: VIC offers a way to compress the feedback loop.

Valuation is Multifaceted: Use multiple approaches + ROIC filter.

Catalysts Matter: Value needs a way to get unlocked—don’t ignore governance.

Up Next: Greenblatt’s Class #2

In the next edition, we’ll look at Class #2—where Greenblatt begins applying these ideas to real-world cases. If Class #1 is the blueprint, Class #2 is the lab.

Don’t Miss Out

If you’re looking to stay ahead of the curve in thematic quality growth investing, subscribe today to receive fresh, insightful posts straight to your inbox.

Thanks for reading ThematicEdge! Your support means a lot.

If you enjoyed what you read, feel free to share it with your friends and colleagues!

I finally know the name of the guy - John Chew - to whom I owe so much. He had the skills of a master librarian and archivist while having the altruism of a samaritan to give it all away for free. Thank you for paying him respect or else I would still to this day not know the name of the guy who gave me and the nascent online world of value investing so much value.