🚀Inside Chris Hohn’s TCI: Lessons from an 18% Compounder (2/2)

How a barbell strategy, and quality-first mindset built one of the best track records in investing

Last week, we looked at the key takeaways from a rare and insightful podcast interview between Chris Hohn, founder of The Children’s Investment Fund (TCI), and Nicolai Tangen, CEO of Norway’s $1.4 trillion sovereign wealth fund (NBIM).

You can listen to it —> here.

Besides delivering a stellar 18% annualized return — nearly matching Warren Buffett’s 20% (over a much longer horizon) — one of the most fascinating insights was that Hohn achieved this with an extremely narrow investable universe. His strategy isn’t just about picking great stocks — it’s about knowing where to fish.

Hohn’s approach reminds us that how you define your investable universe can be just as important as stock selection itself. So I dug into the companies he invests in — and some that he doesn’t — to reverse-engineer the structure of that universe. And there’s a clear pattern:

📌 TCI’s universe is built like a barbell: part of the portfolio is in safe, highly predictable businesses — the other part is in riskier, high-return opportunities.

This barbell approach stands out because many high-performing managers go all-in on the risky side. But TCI has managed to generate elite returns while anchoring a large portion of its portfolio in durable, low-volatility assets.

Let’s break down the TCI barbell — starting from the safest businesses and working toward the more cyclical and growth-oriented end.

🧱 The Safest Side: Infrastructure (Airports, Toll Roads, Railroads)

About 15% of the current portfolio is in North American railroads, with an additional 2% in Ferrovial, a Spanish operator of airports and toll roads.

TCI has also historically held wireless tower operators and select real estate companies, please see below.

These businesses all share a key trait:

👉 Irreplaceable physical assets + natural monopolies.

Nobody builds a second airport next to the first. The upfront capital required is enormous, and regulatory barriers are high. The same applies to rail networks, toll roads, and telecom towers.

Once built, these businesses can earn monopoly-like economics for decades, provided they don’t abuse pricing. The cash flow visibility is excellent — the main challenge is getting the timing and entry point right.

📌 I’ve also listed some close peers below that TCI hasn’t invested in directly, but which likely fall within their universe.

🏥 Defensive Industry #2: Healthcare

Currently, TCI holds no healthcare positions — but it has made two past investments:

Elevance Health (formerly Anthem) – U.S. managed care giant

Thermo Fisher – Global life sciences tools provider

Both businesses had high market share, served essential functions, and offered predictable, non-cyclical revenues.

Though TCI exited both positions, their inclusion suggests that dominant, non-disruptable healthcare companies are fair game, especially those with scale advantages and low exposure to reimbursement risk.

Switching insurers, like Elevance, is painful for large employers — it disrupts employee access, systems integration, and benefits design. This inertia protects incumbents like Elevance.

Once a lab integrates Thermo Fisher’s equipment and protocols, changing vendors can disrupt workflows, retrain staff, and risk regulatory setbacks. This makes customer relationships sticky.

💡 Peers in life sciences tools, diagnostics, or healthcare data likely remain within TCI’s watchlist — even if not currently held.

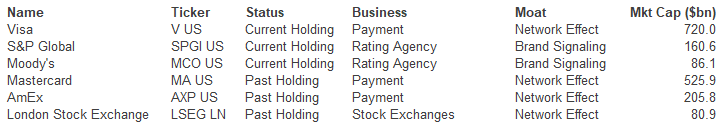

💳 Rather Defensive: Financial Infrastructure & Platforms

While TCI avoids banks and insurance companies, it is heavily exposed to financial rails:

36% of the portfolio is allocated to rating agencies (Moody’s, S&P Global) and payments networks (Visa)

Past holdings include American Express, London Stock Exchange, and IHS Markit

Visa & Mastercard benefit from a powerful two-sided network effect:

Consumers want cards accepted everywhere. Merchants want to accept the cards everyone uses.

Result: a natural oligopoly with excellent pricing power.

Credit rating agencies are even more entrenched:

Their services are legally required for bond issuance, and there's only two of them.

Exchanges like LSE also benefit from liquidity-driven network effects:

More trading attracts more participants, reinforcing dominance.

These are digital monopolies, monetized through transaction fees and data services.

In the chart below, you can find the peers of current and previous investments.

⚙️ The Growth Side of the Barbell: Industrials (Aerospace & Defense)

24% of TCI’s portfolio is in industrials — largely aerospace and defense.

These companies are capital-intensive and cyclical on the surface, but they come with hidden stability:

Long product cycles (20–50 years for engines and aircraft)

Massive switching costs (due to certification, regulation, and integration)

Aftermarket revenue (engines and defense platforms have long tail cash flows)

Think of it this way: once a jet engine is in the sky, you’ve locked in decades of high-margin service revenue. That’s what makes companies like GE Aerospace, Safran, Rolls-Royce, and Raytheon so attractive — despite the upfront complexity.

🧠 The Riskier End: Software & Technology Platforms

22% of the portfolio is in tech stocks.

These carry higher growth expectations — and higher valuations — but the ones TCI chooses tend to have deep moats:

Key Moats:

Switching Costs: It’s painful to migrate 200 staff from Microsoft Office to Linux or Google Docs.

Network Effects: Meta and Alphabet grow stronger as more users and advertisers join.

Chris Hohn specifically called Meta a business with a network effect similar to Visa — hard to replace, and deeply entrenched.

🧩 TCI prefers mission-critical, enterprise-grade software (like Microsoft) and platforms with dominant digital ecosystems.

💡 Not every name in this group is a current TCI holding, but the logic used to select them fits Hohn’s overall framework.

🧠 Final Thoughts: Risk Without Recklessness

“We don’t like things which are discretionary.” – Chris Hohn

That mindset runs through TCI’s portfolio. Even the riskier names are picked based on pricing power, recurrence, and essentiality — not just top-line growth.

What makes TCI’s barbell unique is that it doesn’t rely solely on hyper-growth names to generate alpha. Instead, it blends durable infrastructure assets with scalable digital platforms, aiming to deliver outsized returns without disproportionate risk.

In a world where many investors chase complexity, Chris Hohn keeps it brutally simple: only own what you understand, and only if it dominates.

Don’t Miss Out

If you’re looking to stay ahead of the curve in thematic quality growth investing, subscribe today to receive fresh, insightful posts straight to your inbox.

Thanks for reading ThematicEdge! Your support means a lot.

If you enjoyed what you read, feel free to share it with your friends and colleagues!