📊 Q1 2025 Thematic Investing Review: What’s Working, What’s Not

A high-level performance recap across major thematic clusters—Tech, Environmental, and Societal.

If you've been following along, you know we've spent the past few months unpacking how different thematic funds and ETFs performed in 2024. From AI-driven tech leaders to semiconductor-powered climate strategies to societal shifts in defense, healthcare, and gaming, the insights were as diverse as the themes themselves.

In case you missed them, here’s the full series on Thematic Edge:

Multi-Thematic Investing in 2024: Which Funds/ETFs Are Winning?

Environmental Investing in 2024: Green Transition Winners & Laggards

Now, with Q1 2025 behind us, it’s time to check in: Have the strongest 2024 performers held up? What’s gaining momentum? And which trends might already be fading?

Macro View: Inflation Down, Uncertainty Up

Q1 2025 was defined by policy shifts and rising geopolitical tension. While global markets were volatile, the MSCI ACWI ended the quarter flat—masking deep divergence under the surface.

Key macro themes:

Interest rates diverged:

The Fed held rates steady after 100bps of cuts in 2024.

The ECB continued easing, cutting its deposit rate to 2.5%.

The Bank of Japan signaled tightening, pushing JGB yields to a 15-year high.

Inflation eased, but recession fears grew:

Global inflation trended lower, but new U.S. tariffs revived inflation concerns.

By March, the focus shifted from price pressures to fears of slowing growth.

The IMF kept its global growth forecast at ~3.2%, but warned of rising downside risks.

Geopolitics re-shaped investor sentiment:

The U.S. escalated its trade war, extending tariffs to nearly all imports.

Europe increased defense spending, with Germany suspending its debt brake.

U.S.-Russia relations thawed, while conflict in Ukraine and the Middle East continued.

Bottom line:

Q1 was a reminder that macro and politics matter.

Policy divergence, trade tensions, and recession risk were bigger market drivers than earnings or innovation.

Sector Performance: Five Themes That Defined the Quarter

With the macro picture set, let’s look at how these forces translated into sector-level market returns. Q1 wasn’t driven by individual stock stories—it was shaped by big-picture positioning.

1. Flight to Safety: Defensives Take the Lead

Utilities (+8%) and Consumer Staples (+6%) rallied as investors sought reliable earnings and low volatility.

In a climate of uncertainty, stability and cash flows mattered more than growth narratives.

2. Hard Asset Rotation: Commodities and Energy Shine

Energy stocks surged +10%, leading global sector performance amid higher oil prices and supply disruptions.

Materials (+5%) followed, supported by inflation hedging and demand for real assets.

3. High Rates Reshape Winners and Losers

Financials (+7%) gained as banks and insurers benefited from higher interest margins.

Tech (–11%) plunged, with rate-sensitive growth names under pressure from rising discount rates.

4. Policy-Driven Realignment

Consumer Discretionary (–4%) and Tech hardware were hit by U.S. tariffs and China export restrictions.

Energy and defense benefited from being “policy-proof,” attracting capital amid global uncertainty.

5. Value Over Growth: A Broad Rotation

Financials, Energy, and Staples led as value sectors outperformed richly valued growth stocks.

Investors rotated into steady earners with modest valuations—“boring” was back in style.

Thematic Funds & ETFs: Momentum and Outliers in Focus

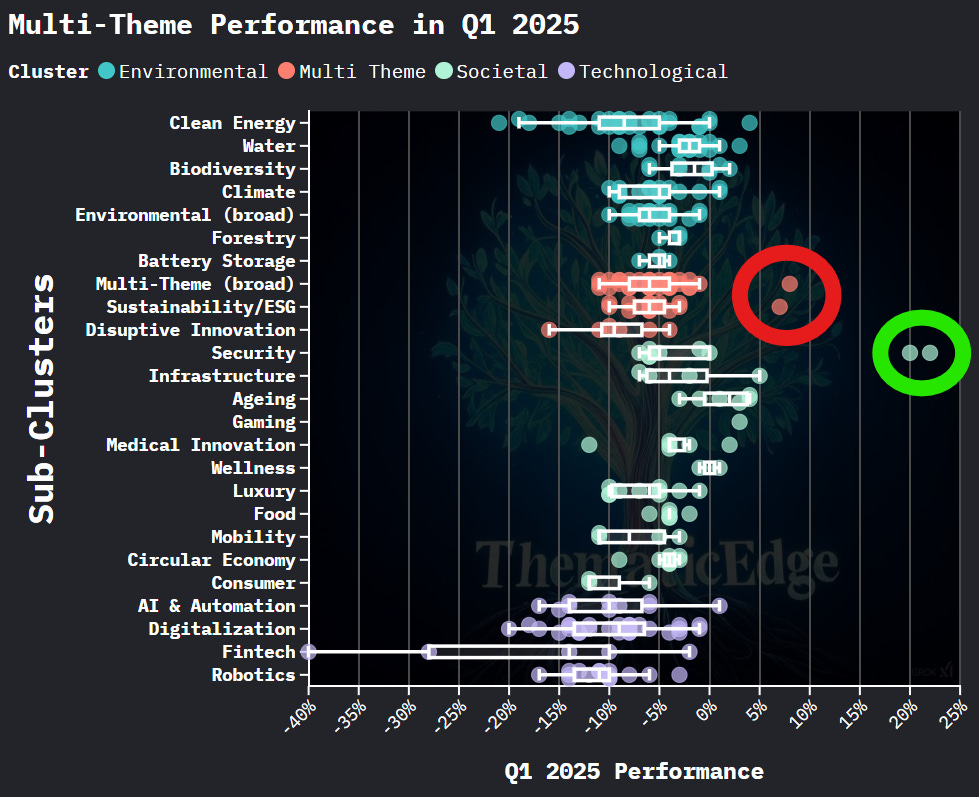

The graphic gives you good overview of the performance of different thematic sub-clusters.

Here’s what stood out:

Multi-theme outliers (in red): Two strategies posted strong Q1 results, but they underperformed in 2024. While notable on the chart, we won’t dive deeper here as the broader track record remains weak.

Security sub-cluster outliers (in green): These are both Defense ETFs that built on their strong 2024 momentum in Q1 2025.

Rising global tensions and increased government defense spending—particularly in Europe—supported continued gains.

U.S. defense names also benefited from tariff exemptions and a shift toward domestic production.

Technology-themed clusters showed signs of fatigue.

Most funds in digitalization, AI, and robotics struggled amid the broader tech selloff.

After several strong years, long-duration tech names repriced under rate pressure.

What about momentum?

To better visualize momentum, we mapped 2022–2024 performance (vertical axis) against Q1 2025 returns (horizontal axis). The goal: find funds and ETFs delivering positive performance across both periods.

Top performer overall:

The VanEck Video Gaming and eSports ETF stood out, delivering strong results in both time periods.

Despite pressure on consumer names more broadly, gaming held up well—backed by resilient demand and strong positioning in digital entertainment.

Created with TradingView Honorable mention:

The iShares Global Infrastructure ETF posted solid performance across both timeframes.

With high exposure to utilities and real assets, it aligned neatly with Q1’s “Flight to Safety” and “Hard Asset Rotation” themes.

Closing Thoughts

Q1 2025 reminded us that macro drivers and policy shifts can reset market leadership fast. Tech and growth had a rough quarter, while defense, infrastructure, and real assets stood strong. Value came back into favor, and selective themes—like gaming—proved surprisingly resilient.

Over the coming weeks, we’ll take a short break from performance tracking to explore some general thematic investing topics.

Then we’ll be back with a deep dive into one of last year’s or this quarter’s standouts: Gaming, Semiconductors, or Defense. Still deciding. Stay tuned!

I Value Your Feedback!

I’m committed to making this newsletter both educational and entertaining.

Your feedback, suggestions, and questions are incredibly important to me.

What topics are you most interested in?

What kind of information would be most helpful to your investing journey?

Feel free to share your thoughts—I’d love to hear from you

Don’t Miss Out

If you’re looking to stay ahead of the curve in thematic quality growth investing, subscribe today to receive fresh, insightful posts straight to your inbox.

Subscribed

Thanks for reading ThematicEdge! Your support means a lot.

If you enjoyed what you read, feel free to share it with your friends and colleagues!