💡 The Magnificent 7 Effect: How It Distorts Performance & What Defines ‘Good’ Returns

Breaking Down Market Concentration, Benchmark Bias & Realistic Return Expectations

Last week, we took a big-picture view of the 2024 market performance, breaking down sector returns, and key drivers of equity gains. One of the biggest takeaways? The outsized influence of a small group of stocks.

The Magnificent Seven—a handful of dominant tech and tech-related companies—were responsible for a significant share of global equity returns. This raises an important question: Are we looking at a healthy, broad-based bull market, or is market performance becoming increasingly concentrated in a few names?

This week, we dive deep into who the Magnificent Seven are, how they’ve shaped market dynamics, and what their dominance means for investors going forward.

Let’s get started. 🚀

Disclaimer

This newsletter is for informational purposes only and should not be considered investment advice. All investments carry risk, and past performance is not indicative of future results. Please consult a financial advisor for personalized recommendations.

The "Magnificent Seven" – What’s It About?

The Magnificent Seven was originally an old Western movie about seven gunmen defending a village from bandits—but we’ll skip the movie details.

As the subtitle suggests, “The Magnificent Seven fought like seven hundred.”

We see a similar dynamic in the stock market: these seven companies are driving ACWI performance as if they were 700 stocks.

Let’s break it down stock by stock and assess their annualized returns since 2019:

Nvidia: 87% annualized return (14x market performance)

Tesla: 71% annualized return (9x market performance)

Apple: 29% annualized return (2x market performance)

Microsoft: 23% annualized return (2x market performance)

Alphabet: 23% annualized return (2x market performance)

Meta Platforms: 23% annualized return (2x market performance)

Amazon: 19% annualized return (2x market performance)

Outperforming the ACWI from 2019–2024 was already a major achievement. But outperforming by 2x, like Alphabet, or by 14x, like Nvidia, is truly extraordinary.

You can see all the data visualized in the Flourish chart below.

A Love Story – The Magnificent Seven & the ACWI

The ACWI delivered a strong 50% cumulative return since 2019 (11% annualized). We know the Magnificent Seven were a key performance driver—but just how much did they contribute?

Breaking the chart down, we see that ACWI returns for 2020–2024 can be divided into two key drivers:

Magnificent Seven contribution: 4.5% annualized over this five-year period

All other ~3,500 stocks: 6.5% annualized return

To put this in perspective:

Only seven stocks contributed 4.5% annualized return

The remaining 3,000+ stocks contributed 6.5% annualized return

Combined, they form the 11% ACWI return

Conclusion: Investors can be happy with ACWI performance, but in reality, it was heavily driven by a small handful of companies. The median return across all ACWI constituents was 7%—solid, but far from spectacular.

How Did the Magnificent Seven Perform in 2024?

Leading into 2024, the Magnificent Seven saw strong performance, and their market caps increased significantly—a crucial factor in ETF construction.

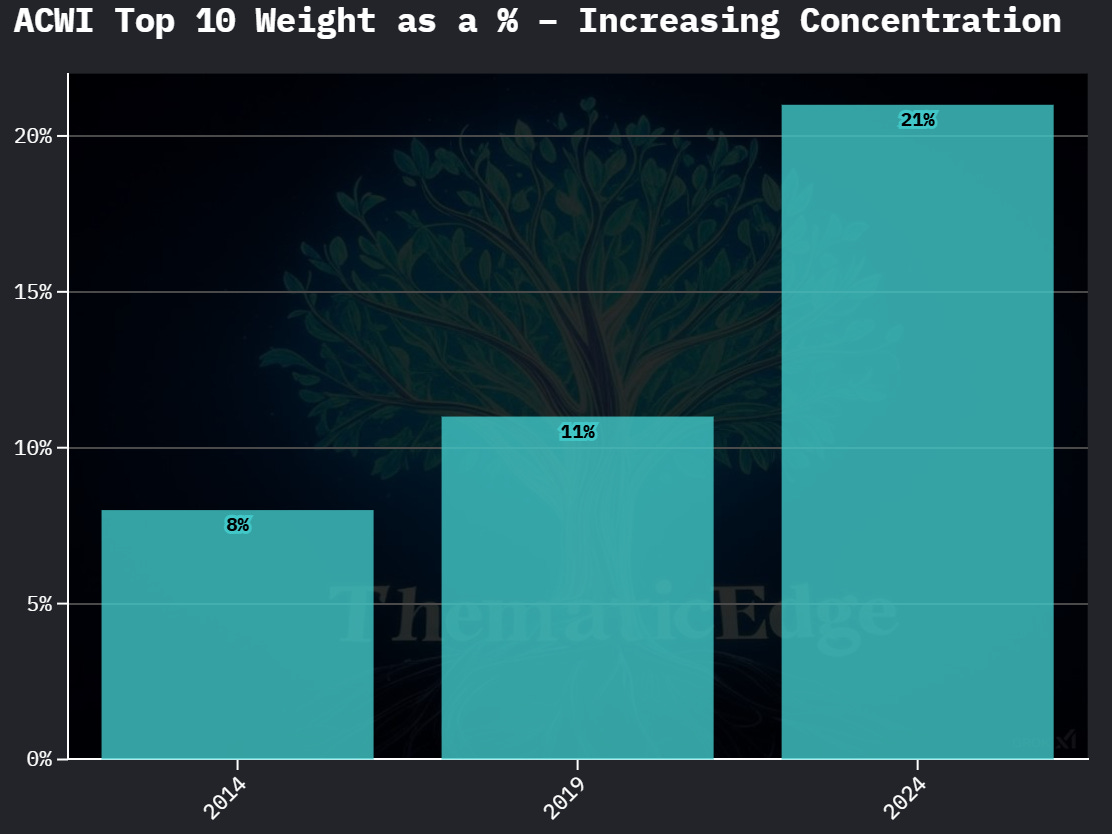

A key way to assess how concentrated an ETF has become is by analyzing the top 10 holdings and their weight. Let’s look at the chart.

Here’s what we observe:

10 years ago, the top 10 stocks accounted for 8% of ACWI assets—a well-diversified index.

By 2019, this increased to 11%, as tech stocks gained value.

By 2024, the top 10 concentration doubled to 21%!

Which stocks dominate the top 10?

Unsurprisingly, all Magnificent Seven stocks are included, along with some top-performing semiconductor companies.

Why Is This a Problem?

The ACWI is widely used as a proxy for global equity performance and serves as a key benchmark.

Seeing an 18% return in 2024 might make investors think it was an exceptionally strong year for global equities. But the reality? The median stock return was just 2%!

What does this mean for different investors?

If you didn’t own any Magnificent Seven stocks → Your return was likely ~2%—not great.

If you owned some Magnificent Seven stocks → Your return was likely 5–10%—a good result, but still underperforming the 18% ACWI.

If you owned most or all of the Magnificent Seven → You had a fair shot at matching or beating the ACWI’s 18% return, depending on your position sizing.

Looking ahead, many thematic funds focus on technology-related megatrends—which often include Magnificent Seven stocks. However, many environmental or societal megatrends do not, making it harder for these strategies to outperform.

This raises an important question…

What’s a Fair Performance Hurdle?

We’ll continue using ACWI as a proxy for global equities, but by now, it should be clear that its performance is significantly influenced by the Magnificent Seven. If a thematic fund isn’t exposed to these stocks, outperforming ACWI is difficult.

To get some historical perspective, ACWI’s annualized return since 2008 is 8%. The further back you look, the more useful these numbers become.

JP Morgan regularly publishes its “Guide to the Markets”, which I highly recommend. It segments market performance into key categories:

Size: Historically, small caps have outperformed large caps, as they carry higher risk and demand a higher reward. However, in the past 10 years, the opposite has been true.

Style: The “value” factor has struggled in a low-yield environment, favoring growth stocks.

For megatrend investors, we typically:

Follow a buy & hold strategy

Seek secular growth tailwinds

Favor growth-oriented companies

Avoid paying excessive valuations but recognize the importance of quality

Are market-cap agnostic, focusing on the best companies within a given trend

Let’s not make this too scientific, but I think it's helpful to frame it properly. The JPM matrix highlights relevant areas for megatrend investors.

As megatrend investors, we are true quality growth investors but market cap agnostic. If we take the median of these six relevant metrics, we arrive at an 11% annualized performance.

I’d like to establish a 10% performance hurdle—anything above 10% annualized over a longer time horizon, including some down years, is considered solid. Of course, we are simplifying things, as this does not account for risk and volatility.

Big picture: Categorizing the secular growth trends

More than $400 billion is invested in funds and ETFs aimed at capturing specific secular growth trends.

I have categorized 273 funds and ETFs into main clusters, and we will conduct a comprehensive 2024 performance analysis of the entire thematic investing fund and ETF universe.

As you can see in the chart, performance is widely spread.

We have some interesting outliers that we’ll cover in upcoming sessions, but I can already tell you that semiconductors, gaming, and defense stocks had a stellar year!

Publication Timeline Ahead

We have four exciting weeks ahead of us!

Here’s the schedule:

📊 2024 Market Review: The Big Picture Before Diving Deeper – Last week

💡 The Magnificent 7 Effect: How It Distorts Performance & What Defines ‘Good’ Returns – TODAY!

🌍 Multi-Thematic Investing in 2024: Which Funds/ETFs Are Winning? – March 6

🚀 Tech Funds/ETFs in 2024: Capturing Innovation or Falling Behind? - March 13

🌱 Sustainable Investing in 2024: How Funds/ETFs Are Performing in the Green Transition – March 20

🔄 Investing in Societal Change: How Thematic Funds/ETFs Are Adapting in 2024 – March 27

This deep dive will equip you with a comprehensive understanding of the stock market and thematic investment universes, enabling you to make informed decisions when selecting funds or ETFs for your portfolio.

I Value Your Feedback!

I’m committed to making this newsletter both educational and entertaining.

Your feedback, suggestions, and questions are incredibly important to me.

What topics are you most interested in?

What kind of information would be most helpful to your investing journey?

Feel free to share your thoughts—I’d love to hear from you

Don’t Miss Out

If you’re looking to stay ahead of the curve in thematic quality growth investing, subscribe today to receive fresh, insightful posts straight to your inbox.

Thanks for reading ThematicEdge! Your support means a lot.

If you enjoyed what you read, feel free to share it with your friends and colleagues!