How Joel Greenblatt Teaches You to Think: Class #3 at Columbia

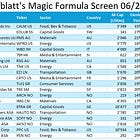

Why Real Analysis Still Beats AI Screens

📚 Welcome back! In our first two posts, we explored the foundational thinking of Joel Greenblatt’s Special Situation Investing class at Columbia.

Catch up here if you missed them:

📚 This week, we’re diving into Class #3 of Joel Greenblatt’s Special Situation Investing course — a session that’s more operational, more practical, and packed with timeless lessons on how to read spinoffs, interpret balance sheets, and avoid the trap of buying companies that merely look cheap.

🧠 And next week, we’ll wrap up the series with Class #4, where Greenblatt shifts gears toward investment philosophy, portfolio construction, and how to think about sizing and holding periods in real-world situations.

Let’s get into it.

💥 Why Spinoffs Create Alpha

Spinoffs are a recurring favorite in Greenblatt’s approach. But what exactly makes them special?

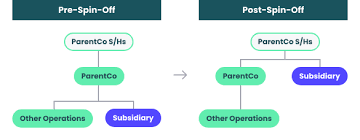

A spinoff happens when a parent company distributes shares of a subsidiary to its shareholders, making the subsidiary an independent, publicly traded entity. Sounds ordinary—but it creates unusual market dynamics.

Spinoffs tend to outperform the market. Why?

“Greenblatt’s analysis in You Can Be a Stock Market Genius found 30%+ annualized returns in selected spinoff situations.”

Here’s why they work:

Forced Selling = Mispricing: Index funds, style-box investors, and size-constrained institutions often dump the spinoff, regardless of fundamentals.

Incentives Improve: Management of the new company is often incentivized with stock and laser-focused on unlocking value.

Strategic Freedom: Spinoffs can pursue niche strategies that didn’t make sense inside the larger parent.

Cleaner Numbers: No more cross-subsidizing—investors get a sharper picture of margins, returns, and capital allocation.

Optionality: These smaller, focused businesses often attract takeover interest or activist campaigns.

What looks like a corporate reshuffling is often a disguised opportunity. But it takes work. The key isn’t just spotting a spinoff—it’s understanding what the market’s missing.

⚔️ Understanding Competition Through Market Share Stability

In investing, you want to avoid brutal, no-moat businesses. But how do you actually gauge the level of competition?

One powerful proxy is market share stability.

“Look at the market share stability... The market share had not changed much—it was predominantly Moody’s and S&P. It was our conclusion that MCO’s growth was likely to continue.”

Moody’s is a great example. Over 25 years, despite massive growth in global public debt, its market share remained stable. That consistency signals a moat. It means clients aren’t price-shopping. It means competitors can’t just show up and steal business.

🛡️ Stable share = pricing power = high ROIC = durable value.

📉 How the Balance Sheet Warns You Before Earnings Misses

This part was one of my personal highlights—and something every analyst should internalize.

“The best method I have ever discovered to predict future downwards earnings revisions by Wall Street security analysts—is a careful analysis of A/R and inventories.”

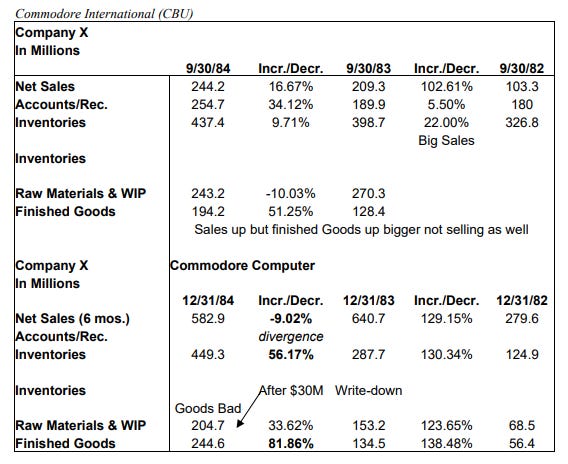

Let’s look at Commodore International (CBU), a classic Greenblatt case study.

📊 In 1983, everything looked great:

Net sales surged over 100%.

Receivables barely budged—real demand, real cash.

📉 But in 1984, cracks appeared:

Sales slowed to +16.7%.

Receivables jumped 34.1%—customers were delaying payment.

Finished goods inventories ballooned by 51.3%—product was piling up unsold.

That’s the canary in the coal mine. It means:

Customers aren’t paying on time.

The company is producing more than it can sell.

Risk of an inventory writedown is rising.

These are early signs of potential earnings disappointment. It doesn’t mean you sell immediately—but it definitely means you dig deeper.

🔁 As Greenblatt would say: the balance sheet tells you what’s coming before the income statement does.

🧠 Microsoft (2007): A Forgotten Value Classic

This case is from an old investment research conference — and it aged beautifully.

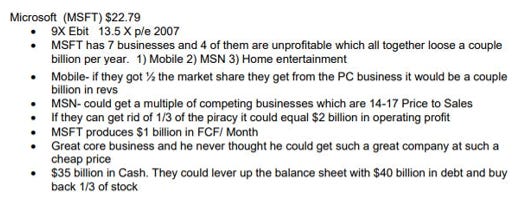

David Einhorn of Greenlight Capital pitched Microsoft in 2007. The stock was trading at just 13.5x earnings.

That was the setup. A dominant business, tons of optionality, massive cash flow, and little love from the market.

Fast forward to today: MSFT has returned 15x+ and became a global AI and cloud infrastructure powerhouse.

Lesson? Great companies sometimes look boring before they become obvious.

🛍️ Joel’s Sister: Investing in Consumer & Retail

In a later part of the course, Joel’s sister gave a talk on consumer and retail investing. At the time, she was compounding at 20%+ until 2007 — very impressive.

One memorable quote:

“Never try to value a company four or five years out based on popularity.”

Don’t chase heat. Look for durability, pricing power, and rational capital allocation. Retail is full of brands that rise and fall on hype—great investors focus on staying power.

🧭 Final Lesson: What Value Investing Really Means

I want to finish the post with a great Greenblatt quote — one that really captures what it’s all about.

“Value investing is not just buying low P/E multiples. In value investing, you are buying something at a discount to what you think it is worth.”

That’s it. That’s the core.

It’s not about spreadsheets. It’s not about smart screens. It’s about judgment, patience, and discipline.

🔑 Class #3 Takeaways

Spinoffs work because of mispricing, realigned incentives, and optionality.

Moats show up in stable market share — not just high margins.

Balance sheets matter — inventory and A/R trends often front-run earnings.

Great ideas need conviction — Microsoft was cheap and ignored in 2007.

Don't chase popularity — durable businesses > trendy names.

Valuation = art + judgment — it’s not about cheap, it’s about value.

Disclaimer

📝 As always, by reading along you agree to the disclaimer. This isn’t advice—just perspective. Do your own work, and remember: Mr. Market is a moody fellow—some days he’s generous, other days irrational. You don’t have to agree with him.

Don’t Miss Out

If you’re looking to stay ahead of the curve in thematic quality growth investing, subscribe today to receive fresh, insightful posts straight to your inbox.

Thanks for reading ThematicEdge! Your support means a lot.

If you enjoyed what you read, feel free to share it with your friends and colleagues!