📉 How Richard Pzena Teaches You to Think: Moats and Valuation - Class #3 at Columbia

Why value investing still matters — even when it feels like it doesn’t

👋 Welcome back to our investing classroom series!

Over the last two editions, we followed Joel Greenblatt’s lectures at Columbia Business School, from special situations to the famed Magic Formula.

This week, we move on to a new teacher: Richard Pzena, a legendary value investor and founder of Pzena Investment Management. Back in 2006, he taught a powerful class on what value investing really means — and why it still works, even when it feels like it doesn’t.

Let’s dig in.

🧠 Why Value Investing Works (or... did)

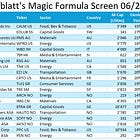

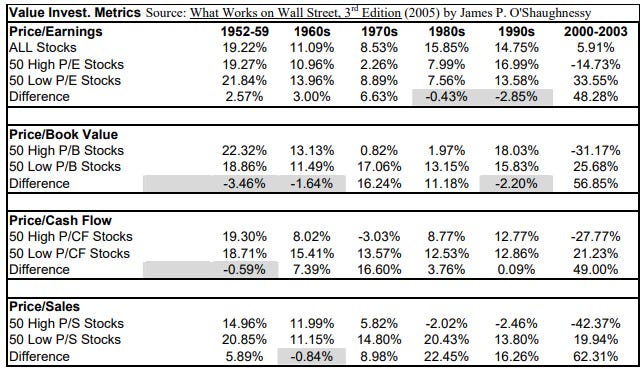

Pzena opens with a punch: back in the day, buying statistically cheap stocks and selling expensive ones worked. Simple metrics like Price-to-Earnings or Price-to-Sales had strong predictive power.

But that was then.

📉 Over the last 20 years, quality growth stocks have dominated. Value, at least the naïve kind that chases low multiples, got left behind — partly due to near-zero interest rates and partly because tech has changed everything.

Yet here’s the nuance:

“Investing goes beyond a simple multiple.”

Even in a tech-driven world, the timeless principle holds: you want to buy good businesses at a good price. Understanding what a good price is — and what makes a business good — is where the edge lies.

🎲 Betting on Mean Reversion (or Not)

Pzena contrasts two types of investors:

“The people who are buying high growth companies are trying to pick the high growth companies that will not revert to the mean... You are betting against the odds when you do that.”

In other words:

Betting on greatness staying great is risky

Betting on improvement is where value is made

💡 The sweet spot? Finding a company that’s good today, but has the potential to become great tomorrow. You buy before sentiment catches up, and let the market re-rate your idea.

🤔 When Everybody Hates It

Being contrarian is a feature, not a bug, in value investing.

“Don’t you read the papers?”

That’s what Pzena says he’s often asked by concerned clients.

“Didn’t you see the terrible earnings or the lost account?”

His response:

✔️ Yes, we read the papers

❗ But we look past the headlines

Cheap stocks are cheap for a reason. The art is in figuring out whether that reason is temporary or permanent. If the issue is fixable — and the management team is capable — you might be sitting on a major re-rating opportunity.

🏗️ What Makes a Business “Good”?

Here’s how Pzena defines a good business:

In this Columbia Value Investing class nearly 20 years ago, Richard Pzena laid out a vivid example to explain why some capital-intensive businesses generate healthy returns — and others don’t:

“Why is it that Boeing over time produces good profit margins but Sprint or Verizon Wireless doesn't—they are both equally capital intensive? Answer: High switching costs. Concentration of the marketplace—wouldn't you say an industry with two players vs. eight players has a higher chance for rational behavior? (Boeing and Airbus make up the two major airplane manufacturers in the world, so the structure of the market is an oligopoly with more rational pricing and high barriers to entry).”

— Richard Pzena, Columbia Business School, ~2006

This insight holds up remarkably well.

Capital alone isn’t the differentiator — it’s market structure and behavior. Boeing benefits from an oligopoly where pricing is rational, competition is limited, and customers face high switching costs. Sprint, on the other hand, operates in a crowded field where margins get eroded by price wars and customer churn.

Even two decades later, this distinction remains a cornerstone of investment analysis.

🚧 Barriers to Entry: What They Really Mean

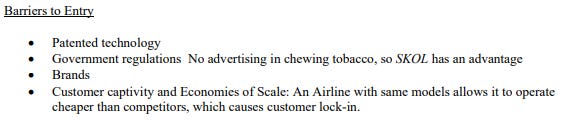

Everyone throws the term around, but what are actual examples of barriers?

And again, in the same class, Pzena explained what separates good businesses from average ones — and used Coca-Cola to illustrate the power of a well-established franchise:

“Coca-Cola has a franchise—nobody spoke about franchises—where it has been built over decades which give Coke a competitive advantage of high barriers to entry. Coke is associated with good things; it has mind share.

I would define a good business where you can identify specifically a reason why it should be able to earn an excess return on its cost of capital. It has to be a simple reason that you can clearly see.”

— Richard Pzena, Columbia Business School, ~2006

It’s not just about branding. Coke’s competitive advantage lies in decades of distribution scale, customer familiarity, and emotional connection — all of which translate into real pricing power and recurring profits.

Pzena’s definition of a “good business” is elegantly simple, and still timeless:

Look for clear, specific reasons why a company should earn more than its cost of capital — and make sure those reasons are durable.

🧮 What This All Boils Down To

In the end, Pzena says it best:

“If I can combine a cheap price with a good business, that is what I am trying to do.”

And isn’t that what we’re all trying to do?

Up Next:

In the next edition, we’ll look at the top and bottom performing megatrend funds and ETFs in Q2 2025 and try to get a better understainding what was driving it from a bottom up perspective but also want to understand the big picture of the market.

on July 10 we continue withe columbia Class #3

Don’t Miss Out

If you’re looking to stay ahead of the curve in thematic quality growth investing, subscribe today to receive fresh, insightful posts straight to your inbox.

Thanks for reading ThematicEdge! Your support means a lot.

If you enjoyed what you read, feel free to share it with your friends and colleagues!