🚀 Tech Funds/ETFs in 2024: Capturing Innovation or Falling Behind?

Analyzing how funds are performing in AI, semiconductors, and disruptive tech.

Last week, we explored multi-theme investing and found that technology was the key driver behind top-performing funds—but not all tech exposure paid off equally. This week, we place tech funds in the broader thematic investment landscape, examining their role within innovation-driven sectors and long-term growth strategies.

Introduction: Framing Tech Funds in Thematic Investing

Technology exposure was critical, but success depended on picking the right stocks.

Nvidia was a defining performance driver, significantly boosting top-performing funds.

Unproven business models and struggling semiconductor segments dragged down underperforming strategies.

Sounds like it’s mostly about tech, right? That’s exactly what we’ll cover this week!

Understanding Tech Funds in the Thematic Investment Universe

There are roughly 60 Tech funds that occupy a unique and dominant position in the thematic investment landscape. As technology continues to shape global economies, investors increasingly allocate capital to funds that capture innovation across AI, automation, cloud computing, and robotics. The scale of investment in technology-focused thematic funds reflects the sector’s potential to drive sustained economic growth and disruption.

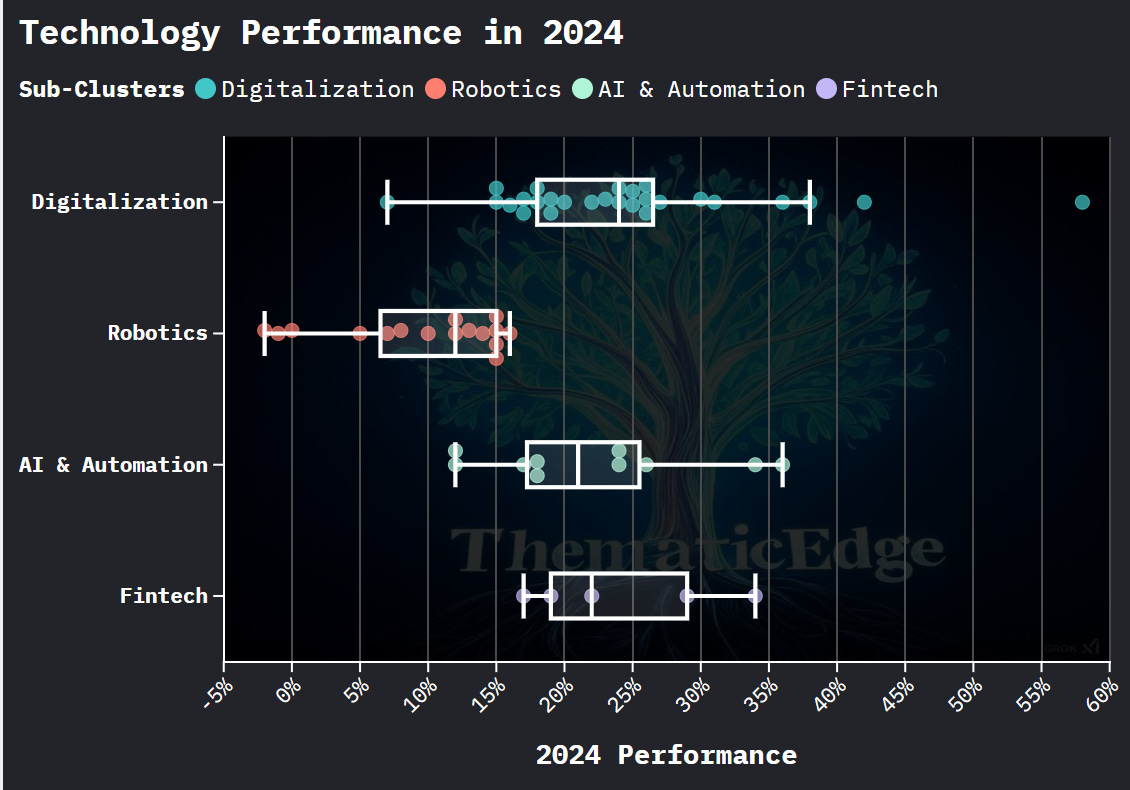

The chart shows that performance across thematic funds varied widely, ranging from -40% to +60%, with technology funds leading the way as the best-performing cluster.

Within thematic investing, technological funds account for approximately 35% of the $420 billion USD allocated to these strategies, making them the largest cluster. Environmental funds follow as the second-largest segment, representing 30% of total AuM.

Breaking Down Tech Funds: Thematic Sub-Clusters

Tech funds can be divided into distinct sub-clusters based on their investment focus, risk profile, and sector exposure. These sub-clusters highlight the diversity within tech investing and how different strategies align with various aspects of digital transformation and automation.

Digitalization: This is the largest sub-cluster within technology funds. The term "Digitalization" covers a broad spectrum, leading to a heterogeneous group of funds investing across cloud computing, software services, and IT infrastructure. The largest player in this space is the Columbia Tech & Information Fund, managing $14 billion in assets.

Robotics: The second-largest tech sub-cluster is robotics, a more homogeneous category. Funds in this space focus on companies driving real-world automation, including industrial robotics and digital automation. Some funds lean toward industrial exposure, while others emphasize technology-driven automation. The largest fund in this space is the Pictet Robotics Fund.

AI & Automation: This cluster is heavily focused on digital transformation and big data, with minimal exposure to physical automation such as industrial robots. Funds in this category prioritize machine learning, AI-driven analytics, and cloud-based AI applications. The largest fund in this segment is the Allianz Global AI Fund.

Fintech: Representing the smallest yet rapidly emerging pocket within tech-focused funds, fintech encompasses a range of financial technology companies. Definitions vary across funds, with some including crypto-related investments as part of their mandate. The ARK Fintech Innovation Fund is the largest fund in this space.

Performance Analysis: Tech Sub-Clusters

We established a 10% performance hurdle as a benchmark to compensate for the risks associated with holding a portfolio of thematic stocks.

Let’s look at the Tech Sub-Clusters!

(Here is a complete guide to box plots)

Examining the box plot Flourish graphic, two key observations stand out:

Digitalization performance was widespread, with one strong outperformer that we will cover in depth later.

Robotics was under relative pressure compared to tech funds, but overall performance remained ahead of our 10% hurdle rate.

Disclaimer

This newsletter is for informational purposes only and should not be considered investment advice. All investments carry risk, and past performance is not indicative of future results. Please consult a financial advisor for personalized recommendations.

Performance Overview: Identifying the Top Performers

For this analysis, we focus on the blockbuster funds, meaning those with over $1 billion in assets under management. These strategies are not only commercially relevant but also act as a quality filter, ensuring we analyze concepts that matter most to investors.

The standout performers in 2024 were Amundi Semiconductors, ARK Next Gen Internet and T. Rowe Price Comm & Tech.

The explanation for the stellar performance of the Amundi Semiconductor strategy is easy, as it focuses solely on the Semiconductor industry, which was a top performing segment of the market. We discussed Nvidia's incredible rise and when you have more than 25% of the portfolio invested in Nvidia, overall performance looks good as well.

ARK Next Gen Internet ETF is a differentiated portfolio that focuses on less mature, high-growth business models. While this approach introduces higher volatility, it worked to investors’ advantage during 2024’s tech bull market. Key contributors to ARK’s success included exposure to crypto assets and AI leaders like Tesla. The fund’s unique positioning resulted in standout performance, though its volatility could act as a double-edged sword in less favorable market conditions.

T. Rowe Price Comm & Tech is an interesting strategy as it aims to capture the digitalization narrative across multiple sectors and performed exceptionally well in 2024.

Lessons from the Underperformers

Rather than naming specific laggards, let’s identify common factors that led to underperformance within this cluster:

Significant industrial exposure within robotics funds acted as a drag compared to the stellar tech-driven performance.

Strategies that did not hold Nvidia struggled to keep up with funds that had sizeable Nvidia exposure.

Underperforming funds had high exposure to Japanese stocks, likely related to industrial automation or semiconductor equipment, which underperformed compared to the leading combination of U.S. & tech-driven strategies.

Key Takeaways and Final Thoughts

Here are three key insights from this analysis:

Betting heavily on the tech sector paid off in 2024, and while this trend is likely to persist over the long term, it won't necessarily do so every year.

Semiconductors are the “picks and shovels” of the AI revolution. We’ll dive deeper into the semiconductor industry after concluding the 2024 performance review.

Fintech is an emerging thematic investment category that may be overlooked by some investors.

Publication Timeline Ahead

We have three exciting weeks ahead of us!

Here’s the schedule:

📊 2024 Market Review: The Big Picture Before Diving Deeper – Three weeks ago

🌍 Multi-Thematic Investing in 2024: Which Funds/ETFs Are Winning? – One week ago

🚀 Tech Funds/ETFs in 2024: Capturing Innovation or Falling Behind? - TODAY!

🌱 Environmental Investing in 2024: How Funds/ETFs Are Performing in the Green Transition – March 20

🔄 Investing in Societal Change: How Thematic Funds/ETFs Are Adapting in 2024 – March 27

This deep dive will equip you with a comprehensive understanding of the stock market and thematic investment universes, enabling you to make informed decisions when selecting funds or ETFs for your portfolio.

I Value Your Feedback!

I’m committed to making this newsletter both educational and entertaining.

Your feedback, suggestions, and questions are incredibly important to me.

What topics are you most interested in?

What kind of information would be most helpful to your investing journey?

Feel free to share your thoughts—I’d love to hear from you

Don’t Miss Out

If you’re looking to stay ahead of the curve in thematic quality growth investing, subscribe today to receive fresh, insightful posts straight to your inbox.

Thanks for reading ThematicEdge! Your support means a lot.

If you enjoyed what you read, feel free to share it with your friends and colleagues!