🌱 Environmental Investing in 2024: How Funds/ETFs Are Performing in the Green Transition

Evaluating climate-focused and ESG fund performance in a shifting market.

Last week, we explored the performance of technology-focused thematic funds, identifying key drivers of success and challenges in stock selection. A major takeaway was that exposure to the right sectors was critical, particularly in AI and semiconductors, while poorly positioned funds struggled due to weaker segments such as semiconductor equipment, industrials, and unproven tech business models.

This week, we shift our focus to environmental investing, analyzing how climate-focused and ESG funds have performed in 2024. As the world continues its transition toward renewable energy, sustainable practices, and carbon reduction, these funds are at the forefront of capitalizing on structural market shifts while facing their own set of investment challenges.

Understanding Environmental Funds in the Thematic Investment Universe

There are more than 100 environmental funds, occupying a unique and dominant position in the thematic investment landscape. Environmental investing is driven by critical global challenges, such as combating climate change, ensuring sustainable water management, transitioning to renewable energy, and preserving natural ecosystems. Together, these themes provide insight into how capital is being deployed to support the global green transition.

The chart illustrates that performance across thematic funds varied widely, ranging from -40% to +60%, with technology funds leading the way as the best-performing cluster.

Within thematic investing, environmental funds account for approximately 30% of the $420 billion USD allocated to these strategies, making them the second-largest cluster in the thematic investment space.

Breaking Down Environmental Funds: Thematic Sub-Clusters

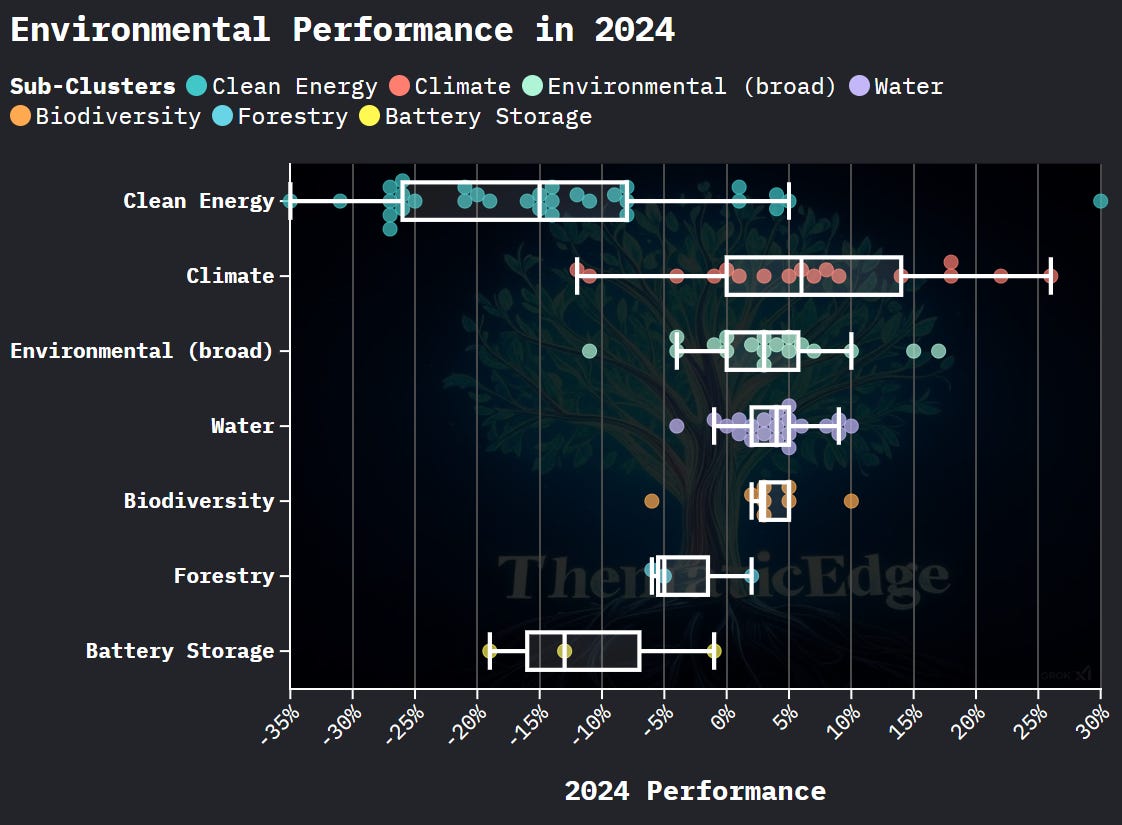

I have grouped the funds and ETFs into seven thematic sub-clusters. Climate, water, and clean energy are well-established investment themes, with numerous blockbuster funds managing significant assets. Environmental (Broad) strategies function as multi-theme approaches within the environmental investment space. The remaining three sub-clusters—Battery Storage, Forestry, and Biodiversity—are currently more specialized, catering to niche investment interests.

Climate: Focuses on companies providing solutions to mitigate climate change.

Water: Targets water infrastructure, desalination, and sustainable water management.

Clean Energy: Invests in renewable energy sources such as wind, solar, and hydrogen.

Environmental (Broad): A diversified mix covering multiple environmental investment themes.

Battery Storage: Concentrates on energy storage solutions for renewable power.

Forestry: Focuses on sustainable timber and land use practices.

Biodiversity: Dedicated to the preservation and restoration of biodiversity.

Disclaimer

This newsletter is for informational purposes only and should not be considered investment advice. All investments carry risk, and past performance is not indicative of future results. Please consult a financial advisor for personalized recommendations.

Performance Analysis: Environmental Sub-Clusters

We established a 10% performance hurdle as a benchmark to compensate for the risks associated with holding a portfolio of thematic stocks. Let’s keep that in mind and analyse the performance of environmental funds ETFs.

Key Observations from the Environmental Tech Sub-Clusters:

Overall Performance: Environmental funds and ETFs generally posted positive returns in 2024 but lagged behind broader market performance, as measured by the iShares ACWI ETF’s 17% return. Technology stocks were a significant driver of overall market performance, a trend we covered in detail last week.

Climate Funds: The best-performing sub-cluster, with a median performance of 6%, yet still below the 10% hurdle rate. Performance varied significantly based on fund strategy—some focused on companies providing solutions for climate change, while others included firms undergoing corporate environmental transitions.

Semiconductor Exposure in Climate Strategies: Some top-performing climate funds benefited from significant semiconductor exposure, as these components are essential for building clean energy infrastructure.

Water Funds: The second-best-performing cluster with a median return of 4%, underperforming global indices. However, the iShares Global Water ETF stood out with a 15% return, largely due to its exposure to utilities, a top-performing sector in 2024.

Performance Overview: Identifying the Top Performers

For this analysis, we focus on blockbuster funds, meaning those with over $1 billion in assets under management. These strategies are not only commercially relevant but also act as a quality filter, ensuring we analyze concepts that matter most to investors.

The standout performers in 2024 were Deka Climate Change, LBBW Global Warming, and Amundi Climate.

A closer look at their top holdings reveals that these funds are more focused on corporate climate and CO₂ emissions reduction rather than companies providing direct products or services to fight climate change. This indicates that the broader industry has faced headwinds in 2024, with the three top-performing blockbuster funds all emphasizing corporate energy transitions rather than pure-play green tech solutions.

One non-blockbuster fund worth mentioning is the VanEck Uranium and Nuclear Tech ETF, which was the overall best performer in this category. Its success highlights the increasing investor interest in nuclear energy as a key component of the clean energy transition.

Lessons from the Underperformers

Rather than naming specific laggards, let’s identify common factors that led to underperformance within this cluster:

Clean Energy Funds Struggled the Most: Clean energy strategies underperformed despite some technology exposure. The biggest drag was poor performance in solar stocks and sector-wide pressures.

Policy Uncertainty: The potential Republican presidential victory in the U.S. led to uncertainty regarding future renewable energy policies, impacting investor confidence in clean energy investments.

Overvalued Green Stocks: Some funds struggled due to high valuations at the start of 2024, which led to correction-driven losses.

Key Takeaways and Final Thoughts

Here are three key insights from this analysis:

Semiconductors as a Driver: Top-performing funds benefited from semiconductor exposure, underscoring their dual role in AI innovation and renewable energy infrastructure.

Nuclear Energy’s Growing Role: The VanEck Uranium and Nuclear Tech ETF emerged as a top performer, reflecting nuclear energy’s increasing importance in the green transition.

Clean Energy Underperformance: Solar and renewable-focused strategies struggled the most, largely due to uncertainty around U.S. energy policy and valuation concerns.

Publication Timeline Ahead

We have three exciting weeks ahead of us!

Here’s the schedule:

📊 2024 Market Review: The Big Picture Before Diving Deeper – Four weeks ago

🌍 Multi-Thematic Investing in 2024: Which Funds/ETFs Are Winning? – Two weeks ago

🚀 Tech Funds/ETFs in 2024: Capturing Innovation or Falling Behind? - One week ago

🌱 Environmental Investing in 2024: How Funds/ETFs Are Performing in the Green Transition – TODAY!

🔄 Investing in Societal Change: How Thematic Funds/ETFs Are Adapting in 2024 – March 27

This deep dive will equip you with a comprehensive understanding of the stock market and thematic investment universes, enabling you to make informed decisions when selecting funds or ETFs for your portfolio.

I Value Your Feedback!

I’m committed to making this newsletter both educational and entertaining.

Your feedback, suggestions, and questions are incredibly important to me.

What topics are you most interested in?

What kind of information would be most helpful to your investing journey?

Feel free to share your thoughts—I’d love to hear from you

Don’t Miss Out

If you’re looking to stay ahead of the curve in thematic quality growth investing, subscribe today to receive fresh, insightful posts straight to your inbox.

Thanks for reading ThematicEdge! Your support means a lot.

If you enjoyed what you read, feel free to share it with your friends and colleagues!