📊 Q2 2025 Thematic Investing Review: Resilience, Rotation & Risk Repricing

A high-level recap across Tech, Environmental, and Societal themes.

If Q1 reminded us that macro and politics drive markets, Q2 took that lesson further.

The quarter opened with a jolt: Liberation Day on April 2, when the U.S. triggered sweeping tariffs that reignited global trade tensions. But despite a sharp early selloff, global equities rebounded—helped by easing inflation, a dovish pivot from central banks, and earnings resilience.

So how did thematic strategies and the overall public equities market fare?

Let’s break it down.

🔍 Macro View: Liberation Day Shocks, Then Dovish Relief

Q2 2025 was a tale of two halves. Risk appetite was crushed in early April as U.S.–China trade tensions erupted. But markets reversed course in May as policy support kicked in and geopolitical fears faded.

Key macro developments:

Liberation Day Tariffs: The U.S. slapped triple-digit duties on major imports, triggering a sharp equity selloff and Chinese retaliation.

Central Bank Pivot:

The ECB cut rates by 25bps in June as eurozone inflation neared 2%.

The Fed stayed on hold but leaned dovish.

The BoE and others followed with small cuts as growth slowed.

Earnings Held Up: Q1 reporting (mostly in April–May) beat expectations, especially in tech and consumer sectors.

Geopolitics Flared, Then Faded: A short Israel–Iran conflict and ongoing Ukraine war added to headline risk. But fears receded into June.

📊 Sector Highlights – What Drove ACWI

The global rebound in Q2 was broad but uneven. Sector leadership flipped from Q1, with long-duration growth roaring back and defensives falling behind.

Here’s what stood out:

1. Growth Strikes Back: Tech Regains the Throne

📈 Technology (+23%) | Communication Services (+18%)

After Q1’s selloff, growth stocks stormed back in Q2. Easing inflation, a dovish tilt from central banks, and resilient earnings sparked a dramatic rebound in rate-sensitive sectors—particularly large-cap tech, AI, and digital media.

2. Industrial Resilience: Rebuilding and Rearming

🏗️ Industrials (+16%) | Financials (+11%)

Infrastructure plays, automation firms, and defense contractors rallied behind steady demand and geopolitical tailwinds. Financials benefited from stable margins and soft-landing optimism.

3. Policy-Exposed Sectors: Pain and Protection

🚫 Healthcare (–4%) | Energy (–4%)

Healthcare lagged as biotech and GLP-1 stocks corrected, but political pressure also played a role. Trump renewed his focus on drug pricing and Medicare cost controls, unsettling sentiment across healthcare payers and pharma. Investors began pricing in potential regulatory risk tied to U.S. election outcomes.

Energy fell despite geopolitical tensions. Oil prices dropped ~15% as OPEC+ raised output, global growth slowed, and Middle East risks eased. U.S. producers turned cautious, with nearly half planning fewer wells in 2025 unless prices rebound. CAPEX cuts and fading inflation hedges added pressure, reminding investors that not all real assets are safe when policy winds shift.

🚀 Thematic Funds & ETFs: Strength in Resilience, Rotation, and Real Assets

The Q2 2025 scatterplot of thematic ETF performance tells a clear story: macro conditions and geopolitical pressures heavily influenced which themes thrived—and which fell behind. Style rotation, interest rate sensitivity, and policy tailwinds all played a role.

🔎 Spotting Winners & Avoiding Laggards in Thematic Investing — Q2 2025 Insights

In Q2 2025, thematic performance was sharply polarized — highlighting just how critical precise cluster classification is when building or analyzing thematic portfolios. Here’s a look at some standout and struggling sub-clusters, along with a few observations on how they were categorized in existing frameworks.

🟢 Themes That Delivered

Clean Energy (Environmental): Powered by renewed investor interest and strong U.S./EU policy tailwinds, clean energy ETFs delivered solid double-digit returns. This sub-cluster remains a core component in sustainability-focused strategies.

Disruptive Innovation (Multi-Theme): Despite its volatility, the category rebounded strongly, with leading funds up over 30% for the quarter. This strength was often tied to embedded exposures in AI and automation.

Gaming (Societal): While often lumped into tech, gaming had a distinct trajectory — outperforming most digital peers. This outperformance came on the back of high engagement levels and minimal China exposure.

Security (Societal): Defense and cybersecurity ETFs extended their Q1 strength, benefiting from global tensions and rising tech infrastructure investments. A few were incorrectly bucketed as "Technological" in some databases, though their drivers were more geopolitical than purely digital.

Fintech (Technological): This was one of the biggest positive surprises. Fintech funds surged — with some blockchain-heavy vehicles up over 60% — challenging the narrative that all rate-sensitive growth themes underperformed.

🔴 Themes That Lagged

Forestry (Environmental): Forestry-linked ETFs posted negative returns amid weak demand and declining timber prices. This remains a structurally challenged corner of the environmental space.

Ageing (Societal): Despite strong long-term demographics, the “Silver Economy” theme was hit by weak performance across healthcare services and ageing-related consumption. Funds in this category declined by up to 10%, often overshadowed by GLP-1 narratives elsewhere in healthcare.

Food (Societal): Sustainable food and nutrition ETFs underperformed, hit by margin pressure, weaker emerging market demand, and limited pricing power. Despite noble goals, performance lagged the broader market.

Wellness (Societal): Often marketed as defensive growth, this sub-cluster failed to protect. It saw outflows and weak sentiment, possibly from investor fatigue with low-growth consumer staples narratives.

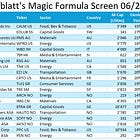

🌟 Top Performing Thematic ETFs in Q2 2025

A few high-conviction, niche thematic strategies stood out in Q2—driven not by macro rotation, but by powerful catalysts within their underlying exposures. These top performers captured asymmetric upside by aligning with policy momentum, asset class recoveries, and long-term secular themes.

1. Global X Uranium ETF

Key drivers: Cameco Corp, Oklo Inc, NuScale Power Corp

This fund outperformed as nuclear energy regained political and commercial momentum globally. Uranium prices climbed in response to growing interest in energy independence, with several Western governments fast-tracking support for nuclear buildouts. Cameco, the fund’s anchor holding, rallied on both pricing tailwinds and increased forward contracting. SMR-focused firms like Oklo and NuScale also saw strong interest following U.S. and European commitments to modular nuclear projects. The ETF benefited from both commodity leverage and next-gen reactor optimism—positioning it as a key play on clean energy resilience amid global instability.

2. VanEck Crypto and Blockchain ETF

Key drivers: Coinbase Global Inc, MicroStrategy Inc, Metaplanet Inc

Crypto-related equities rebounded sharply in Q2, and this ETF was a prime beneficiary. Regulatory clarity improved in the U.S., as the SEC signaled openness to spot Bitcoin ETFs and clarified treatment of crypto platforms—removing a major overhang from Q1. Coinbase surged on rising trading volumes and institutional interest. Meanwhile, MicroStrategy and Metaplanet gained as Bitcoin prices recovered and these companies expanded their on-balance-sheet crypto holdings. The ETF’s strong performance reflects the renewed confidence in crypto infrastructure and the legitimization of digital assets as a strategic allocation.

3. iShares Blockchain Technology ETF

Key drivers: Coinbase Global Inc, Core Scientific Inc

Unlike crypto-native ETFs, this fund captured the broader blockchain recovery through infrastructure and compute plays. Coinbase again contributed meaningfully, but the standout was Core Scientific—a major miner emerging from restructuring with restored hash power and leaner operations. The ETF benefited from a rising tide in blockchain services adoption, including tokenization initiatives and backend enterprise use cases. It also gained indirectly from investor interest in the AI–blockchain convergence, which spotlighted the computational backbone behind decentralized systems.

🔚 Closing Thoughts

Q2 proved that thematic investing rewards selectivity, not slogans.

While broad growth rotated back into favor, the real outperformance came from themes with clear catalysts: nuclear energy aligned with national priorities, blockchain matured beyond crypto hype, and digital assets re-entered the institutional mainstream.

In a noisy macro environment, the strongest themes weren’t always the loudest—but they were the most aligned with where policy, capital, and innovation are actually flowing.

📚 Next week, we continue our education series with Joel Greenblatt’s Class #3 at Columbia. Don’t miss it.

Disclaimer

📝 As always, by reading along you agree to the disclaimer. This isn’t advice—just perspective. Do your own work, and remember: Mr. Market is a moody fellow—some days he’s generous, other days irrational. You don’t have to agree with him.

Don’t Miss Out

If you’re looking to stay ahead of the curve in thematic quality growth investing, subscribe today to receive fresh, insightful posts straight to your inbox.

Thanks for reading ThematicEdge! Your support means a lot.